Spreads are indeed important for traders to consider when participating in forex trading. It is a cost incurred from every transaction made. Spreads represent the difference between the buying price and the selling price.

In this article, we delve into the realm of forex trading spreads, vital for traders to comprehend as a transaction cost, alongside other trade-related expenses.

Introduction

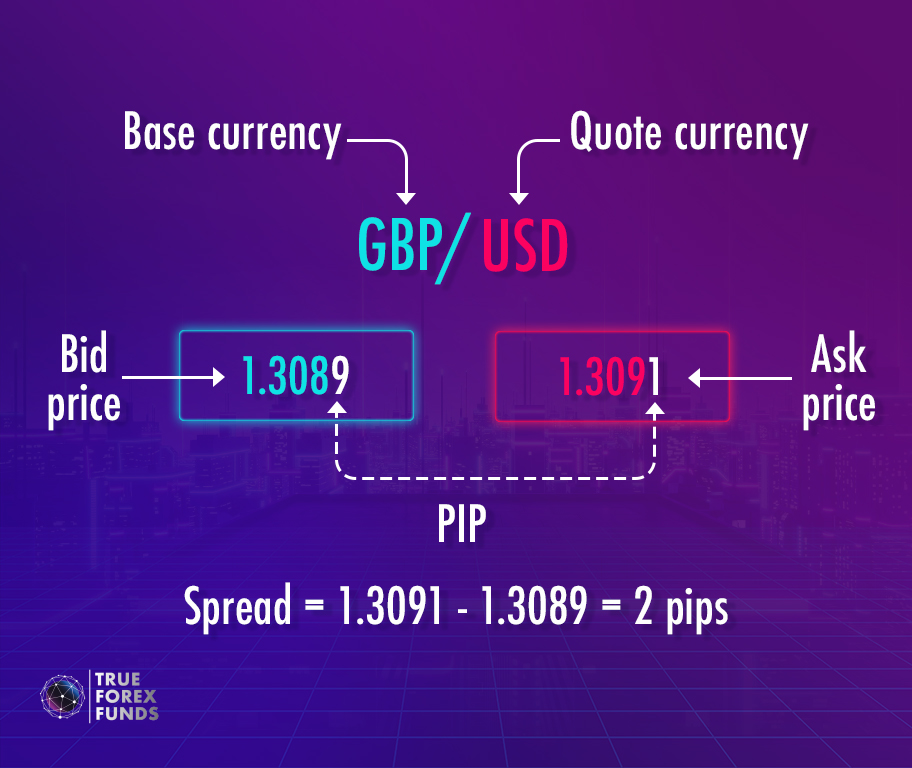

Forex trading is the simultaneous buying and selling for different currencies at their respective exchange rates, with the expectation that the rate will move in favor of the trader. When trading currencies, there is a quoted pair to remember: one currency serves as the base currency, while the other takes the role of the quote or counter currency.

You can sell a currency at one exchange rate and buy the same currency at another rate. The difference between the two prices is called the forex spread.

At its core, the spread is the cost at which you can execute a forex transaction and as such it is a vital notion in forex trading.

What Are Spreads In Forex Trading?

When you open a forex position you will see two prices displayed for a currency pair:

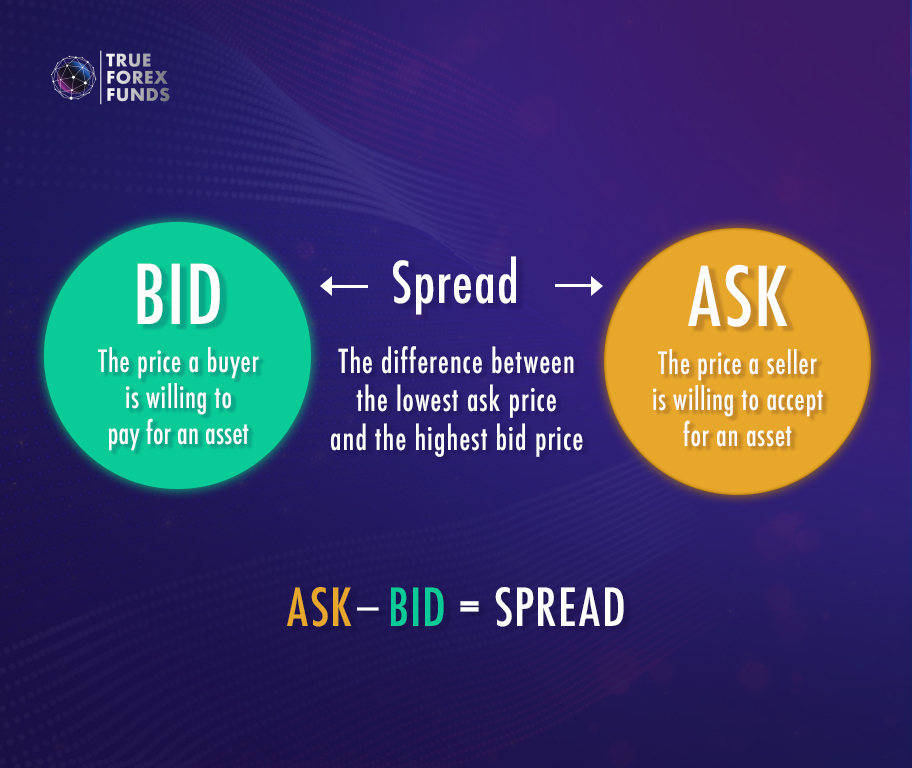

1. The bid price at which you can sell the base currency (the first currency of the pair)

2. The ask price at which you can buy the base currency.

In most cases, there will be a difference between the two prices and this is the spread, which is often referred to as bid-ask spread or buy-sell spread.

The spread is measured in pips, the smallest unit of measurement for the change in the price of a currency pair. Pips denote the change in the fourth decimal of the exchange rate. However, an exeption is pairs quoted in the Japanese yen (JPY), where the pip is the second decimal. When the difference between the two prices is small, the spread is narrow or tight. Conversely, when the difference is bigger, the spread is wide.

True Forex Funds works with multiple liquidity providers to offer clients world-leading trading conditions. If you open a raw spread account, you can start to trade forex from 0.0 pips.

Start to Trade Forex 0.0 Pips Today!

Get fundedEssentially, the spread is a cost that forex brokers build into the price of every currency transaction executed through them. They sell the currency to you for more than what they paid for it and they buy the currency from you for less than what they will sell it for.

This is the fee they charge for their service. In forex lingo, people say that the spread incorporates the cost.

Some brokers work with very narrow or 0 spreads but they charge a fixed commission for every trade. One way or another, you will have to pay for the service they provide.

Types of Forex Spreads

Forex spreads come in two main types:

- fixed spreads

- variable spreads

As the name suggests, fixed spreads stay the same regardless of what happens in the market. Trading with fixed spreads means that you can work with more predictable transaction costs as a volatile market won’t affect the spread and your capital requirements will also be smaller. If you are new to forex trading, fixed spreads are probably a safer bet for you.

As with most things in life, fixed spreads come with some disadvantages, the most typical being requotes and slippage. At times of high volatility, your broker may refuse the price at which you want to place a trade and it will ask you to accept a new price. This is called being “re-quoted” with a new price. Slippage occurs when your trade executes at a rate different from your order. This will happen at times when volatility is high in the market and prices change fast.

Variable spreads, also known as floating spreads, fluctuate based on market conditions. In times of heightened volatility, such as during the release of major economic news, the spread tends to expand. These types of spreads can be beneficial in calm market situations as they can be lower than fixed spreads.

At True Forex Funds, we provide raw spreads to our traders.

Raw spreads, devoid of any markup, represent the pure spreads sourced directly from the interbank market. This market comprises major banks and liquidity providers with no added fees!

Typically, raw spreads are the narrowest available to traders, subject to variability, and can even reach zero during periods of high liquidity.

How to Calculate Spreads in Forex Trading

Example 1

Here’s an example of how forex spreads work. Let’s assume you want to open a EUR/USD position and the sell price is 1.3089 while the buy price is 1.3091 for the currency pair. If you subtract the buy price from the sell price you will get the spread, which in this case will be 2.

The formula used for calculating spreads is the following:

Example 2

In the case of currency pairs involving the Japanese yen, they typically have quotations with only two decimal places. For example, if you see the USD/JPY pair quoted as 108.10/108.12, you have a spread of 2 pips.

Now that we know how to calculate the spread in pips, let’s look at the actual cost incurred by traders. Using the EUR/USD quotes above, we can buy the currency pair at 1.2187 and close the transaction at a sell price of 1.2185. That means as soon as the trade is open, you will incur a spread of 2 pips. To find the total spread cost, you will need to multiply this value by the pip cost while considering the total amount of lots traded. When trading a 10k EUR/USD lot, you would incur a total cost of 0.0002 ( 2 pips) X 10,000 (10k lot) = $2. If you were trading a standard lot (100,000 units of currency), your spread cost would be $20.

Also, we can calculate the spread %:

Now that we know how to calculate the spread in pips, let’s look at the actual cost incurred by traders. Using the EUR/USD quotes above, we can buy the currency pair at 1.2187 and close the transaction at a sell price of 1.2185. That means as soon as the trade is open, you will incur a spread of 2 pips. To find the total spread cost, you will need to multiply this value by the pip cost while considering the total amount of lots traded. When trading a 10k EUR/USD lot, you would incur a total cost of 0.0002 ( 2 pips) X 10,000 (10k lot) = $2. If you were trading a standard lot (100,000 units of currency), your spread cost would be $20.

Using Spreads to Manage Your Costs

As shown by the above example, a wider spread entails higher costs while a narrower spread will reduce the costs of your trade.

Spreads play a crucial role in setting up and executing your forex trading strategy. In a scalping strategy, for instance, you will seek to capture tiny market movements with large positions within a very short time.

At most forex brokers, you can monitor live spreads on the trading platform. In TradingView, you can find the spread displayed actively in the Buy/Sell section of your chart, located in the upper left corner.

Spread Betting vs. Traditional Forex Trading

Spread betting is a popular form of trading where traders bet on the direction of a certain financial asset rather than buying or selling the instrument in question. Instead of buying or selling a set amount of shares or currencies, you bet an amount based on every point the market moves. As a trader, you will try to calculate whether the price of a currency pair will rise or fall over a specified time frame.

Similarly to regular forex trading, you can use leverage in spread betting, which allows you to open larger positions with a small initial investment. While the use of leverage can potentially amplify your wins, it can also amplify your losses. As spread betting is trading structured as a bet, there is no capital gains tax on spread betting profits in many jurisdictions.

Factors that Affect Spreads in Forex Trading

The size of a spread depends on a variety of factors, such as the currency pair involved, market volatility and liquidity, economic and political events, data releases, etc.

Generally speaking, major currency pairs have narrow spreads (of between 1-5 pips) while exotic pairs come with wider spreads. A 30 pip spread on the EUR/USD pair is highly atypical and would suggest a major market event or crisis. The main reason is that demand for major currencies is much higher. So, massive trading volumes in these currencies actively result in narrower spreads.

Navigating Market Dynamics

Economic and geopolitical events can have a major influence on forex spreads. An unexpected interest rate change, a higher/lower-than-expected inflation figure or a policy speech by a central banker flagging interest rate changes can cause currencies to weaken or strengthen and consequently spreads will widen or narrow significantly. Forex traders follow economic calendars to know of upcoming data releases and events and prepare for changes in spreads.

The market may move abruptly and be quite volatile during periods when events are occurring. When there is a high level of volatility in the forex market, spreads may widen drastically and currency pairs can incur gapping.

Timing Your Trades

The time of day also plays a role in the size of the spreads. When major financial centers such as London, New York and Sydney are open, they tend to be more liquidity in the market. As a result, spreads are likely to be lower. This is particularly true when, for example, trading hours in London and New York overlap. Many forex traders prefer to schedule their trades for these periods of time as high liquidity can lead to narrower spreads.

Summary

In forex trading, the spread is the difference between the bid (sell) price and the ask (buy) price of a currency pair. The spread is measured in pips. And, its size depends on a number of factors, including the currency pair in question, market volatility and liquidity. If a market is very volatile and liquidity is low, spreads tend to be wider. To calculate the forex spread, subtract the buy price from the sell price.

Forex traders actively prefer narrower spreads as they constitute the primary cost of a currency trade. Thus, they make their trades more affordable. Some brokers offer narrower spreads but charge a fixed commission per trade.

There are trillions of dollars zipping around on the forex market. If you want to be part of the action, you will need to open a trading account at a forex broker.

Learn the basics of forex trading and become a funded trader with True Forex Funds.

True Forex Funds is a fast-evolving proprietary trading firm. We offers a funding program of as much as $400,000, with raw spread accounts starting from 0.0 pips.

To access to True Forex Funds’ capital to trade, you will need to pass a 2-phase evaluation to demonstrate your skills.

FAQs

The spread is the difference between the bid (sell) price and the ask (buy) price of a currency pair. After each forex transaction, the trader incurs the spread as a cost. It is a primary source of income for forex brokers. The size of the spread, measured in pips, depends on many factors, such as the currency pair involved, market volatility and liquidity. Major events and macroeconomic data releases can also drive spreads.

The spread in forex denotes the difference between the buy and the sell price in pips. You can calculate the spread by subtracting the bid price from the ask price. For example, the spread for EUR/USD, quoted as 1.2185/1.2187, is 2 pips.

Spread betting is a derivative product where you trade with leverage without owning any currency. In spread betting, a trader places a bet on the direction the price of a currency pair will take without transacting in the foreign exchange market. In certain countries, proceeds from spread betting are exempt from capital gains tax.

Raw spreads are the same as the spreads offered by liquidity providers to the broker. When traders get low spreads from their brokers, it means they excluded the cost from the spread. So, these spreads are usually lower than traditional spreads. A raw spread trading account, also often called an ECN account, offers real market prices. Yet, traders have to pay a commission fee for each trade executed.

For major currency pairs, the typical spread is between 1-5 pips. This may widen at times of market turbulence. There are brokers where forex spreads are 0, but traders need to pay a fixed commission per trade. At True Forex Funds, the spreads also start at 0.0 pips.