Whether you participate in the True Forex Funds Evaluation process or go straight into the funded account trades, consider adding gold to your asset list in 2023. Gold trading is one of the most overlooked assets listed on forex platforms.

Some prop firms prohibit gold trading for various reasons best known to them. While many may claim that it is due to risk management principles, the truth is that some prop firms do not exist to become your partner in progress. Instead, they thrive mostly on charging fees for evaluations that they know will lead nowhere.

However, any prop firm worth its salt that sees the success of its traders as theirs will do all it can to ensure that these traders can profit from their capital allocations. One of the strategies that prop firms can use to ensure that their funded traders can make money is by providing assets that command sufficient volatility to make good money and which will remain volatile enough to provide such opportunities for a long time.

This is where gold comes in. Gold is listed on True Forex Funds as XAU/USD and is available for all prop traders with True Forex Funds, be they traders undergoing evaluation or those with funded accounts. Here are some reasons why gold should be on the menu of every True Forex Funds prop trader in 2023 and beyond.

Reason 1: Gold is the asset best suited for the times we live in

Whenever there is economic uncertainty such as the one the world has witnessed since the onset of the COVID-19 pandemic, investors turn to gold to preserve the value of their assets. It is possible to hold other asset classes and be worth billions and have it all come to nothing if an event shakes the market valuation of such assets. You can hold millions of dollars worth of stocks, cryptos, or real estate and have it all come down to nothing. There are several examples of people who had it all in these assets and lost it all. Hui Ka Yan and Sam Bankman-Fried are just two examples of those who lost their billions, notwithstanding the circumstances of such losses.

But there has never been a time when investors with gold holdings lost everything. This is because gold has a unique property: it is the best store of value. Even though there are price fluctuations within the context of near-term time frames, gold’s value has continued to increase over time. For instance, from 2000 to 2022, the value of gold grew from just under $300 an ounce to nearly $1900 an ounce.

For your True Forex Funds live trades and evaluations, we do not expect you to buy and hold gold for 20 years or more. Instead, you will try to profit from the intraday fluctuations in price. Since 2020, gold prices have shown more intraday fluctuation than at any other time in history. It is a vibrant asset that can be traded with the potential for significant gains.

Reason 2: Gold has higher volatility than most currencies

The profit potential of any asset lies in its volatility. You need the asset to have high volatility and range of movement to produce the kind of gains that will make your True Forex Funds journey worthwhile. After all, how can you make a profit if the price of an asset does not change much?

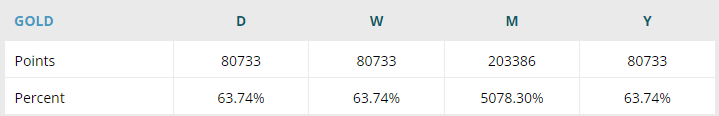

A trading analytics firm did a study to measure the volatility of gold on an hourly, daily, weekly and monthly basis. Their results are shown in this snapshot below:

We can see that gold moved a combined total of 80,733 points in the 2021 trading year, corresponding to a 63.74% volatility-weighted index. This means that if a trader traded every point move using a Standard Lot size (which is $10 per pip), a total of $807,330 would have been up for grabs. In 2022, the lowest recorded intraday points move on the XAU/USD pair was 792 points, while the highest recorded points move was 9,600 pips.

Let us look at the data on gold’s daily volatility. Thursday was the most volatile day for gold in the year under review, with a 2638 points average price move equivalent to 1.47% daily price movement. Monday was the least volatile day, with 2382 points or 1.32%. The reason for this is not far-fetched, and we will address this in the next point.

Reason 3: The Fed’s rate decisions will impact the XAU/USD pair

During the worst COVID-19 pandemic in 2020, central banks worldwide were forced to lower interest rates to near-zero levels to combat the economic impact of the disease on the global economy. Cheap capital and free money from various pandemic stimulus programs entered the global financial system. By 2021, the excess cash had started to exert upward pressure on inflation, driving many countries’ consumer price indices to double-digit levels. The Fed had to start raising rates very sharply in mid-2021 leading to a sharp rise in the US dollar value. Since then, volatility on the XAU/USD pair (gold) has increased significantly.

Inflation is now cooling off in the US, but it is yet to return to pre-pandemic levels. The Fed has also indicated that it would reduce the size of its rate hikes, but would continue to push rates higher until its inflation targets are met. This means that there is going to be room for a lot of speculation on interest rates, which will impact the US Dollar and hence the XAU/USD pair. The implication of this is that there will be a lot of trading opportunities on the XAU/USD pair in 2023. If you are a funded trader or taking evaluations on TrueForexFunds, this could be your chance to ride a train that comes once in a long while.

Understanding the contract specifications for gold trading

What contract specifications will you encounter when trading gold under the True Forex Funds evaluation or funded trading programs? Contract specifications refer to aspects of the market microstructure surrounding gold trading, such as:

- Spreads

- Lot sizes

- Point value

Here is what you will encounter with TrueForexFunds.

a) Spread

The spread for gold, represented by the XAU/USD pair, is 5 pips. This spread is one of the lowest in the industry and shows just how far the markets have come. In the 2000s, many brokers of that era offered high spreads for gold. This writer once traded with a broker whose spread on the XAU/USD was as large as 80 pips. But today, any trade you place on the XAU/USD asset on True Forex Funds’ brokers will only set you back 5 pips in spreads.

b) Lot size

You can trade with as low as 1 micro lot (0.01 lots or $1000 contract size) or up to 100 lots if you have a large capital pool. In any case, the MT5 platform restricts trade sizes to 100 lots, but many of you will not need to trade such large amounts anyway. There is a lot size for everyone, whether you are trading the $10,000 account or the $200,000 account (or the equivalent sums in Euros and Pounds).

c) Point value

The point value is the monetary equivalent of a price fluctuation of one tick on a metal commodity such as gold. You may have seen earlier that we refer to the price moves in gold in terms of points and not pips. This is because these two terms do not mean the same thing, even though they refer to the same event on different assets (i.e. units of price fluctuations).

- A point is the smallest whole-number unit of price change in a futures or commodity asset. A point is composed of tinier subdivisions of price moves known as ticks.

- Ticks are subdivisions of a point move in price. Each tick carries a particular fractional value. Tick values vary from asset to asset. For gold, this is 0.10 points. In silver, it is 0.25 points.

To trade gold properly and conform to acceptable risk standards, you must know the value of a price fluctuation in points. For gold, the point value of a micro-lot is $0.10 (10 cents). For a mini-lot (0.1 lots), it is $1. A point move on a trade set up with a Standard Lot incurs a $10/pip value. The direction and extent of the price move in ticks/pips and the lot size of your trade will determine how much you profit or lose.

In a subsequent article, you will get a detailed explanation of how the point and tick values are calculated.

Aspects of TFF’s trading rules that favour gold trading

Every prop firm presents its rules that its traders must abide by. True Forex Funds has worked to make it easier for its traders to take on the markets in the same conditions they would be subjected to if they were to trade their funds. Some prop firms have very restrictive rules, which make it much harder to pass their evaluations. True Forex Funds understands that its traders are partners in progress. With proper direction and supervision, traders on True Forex Funds are given a set of rules that allow them the freedom to explore all potentials to profit from the market.

What rules do the True Forex Funds live trading and evaluation processes have in place that will favour gold trading?

- News trading is allowed on True Forex Funds. So you can comfortably use the news of a Fed interest rate decision to trade gold without fear of being bounced from the program.

- You can hold positions overnight (subject to proper risk management). A historical look at the recent performance of gold has shown that some of the big moves that have followed recent Fed decisions and Non-farm Payroll reports came a day after the data became public, not necessarily on the event day.

- If you are a fan of expert advisors, you can deploy them to trade the XAU/USD pair.

Gold is a news-driven event. It is unimaginable to trade the XAU/USD pair without the news.