Hello there!

Hope you are enjoying our blog posts, designed to make you a better trader and also help you pass the True Forex Funds evaluations if you are at that stage. This topic is important because many traders still need clarification on how contract specifications for their preferred assets will impact their trade outcomes. This topic will zero down to contract specifications of various asset classes, explaining the various units of measurement of price moves and how these translate monetarily into trade costs, profits, or losses.

The essential elements of contract specifications for assets traded are:

- Contract size (minimum and maximum)

- Units of price move measurement (ticks, points, pips)

- The monetary value of the tick, point, or pip.

- Swaps (rollover costs for maintaining overnight positions)

It is essential to know the minimum contract size of your preferred asset. That way, you know what you stand to gain or lose. You also know the limits to which you can set your lot sizes, as risk management is a crucial element of the trading venture.

You may have noticed that all assets are not created equal. Some are volatile and have wide daily ranges, while others are more docile and respond only to crucial market information. The price quotation systems also differ from one asset class to the other. You have to know how the price moves of your preferred assets are measured, as this information tells you what to expect regarding volatility and trade costs.

How much do you stand to make or lose in a trade if asset X moves in a particular direction and hits a specific price? How is the determination of the price change from the entry point to the exit point made? How do such price changes translate into money? Whether you are in the two-stage True Forex Funds evaluation programs or you are a qualified True Forex Funds Funded Trader, your goal is to make money for yourself and True Forex Funds. The evaluation programs come with targets: what you need to make to move to the next stage, how much you should avoid losing in a day or in total, and the time frame within which you must hit the required targets for your level. Understanding the monetary value of such moves is what takes you to the next level as far as this point is concerned.

True Forex Funds allows you to hold positions overnight and on weekends. You may sometimes need to sit out certain trades for days to see them hit your targets. Holding positions overnight and on weekends attracts charges, and depending on the asset, you may receive interest or have to pay them as a rollover cost. Knowing your swap costs will let you know how to manage them.

Aspects of the contract specifications for Gold

Here is an explanation of aspects of the specifications for gold trading.

1) Contract Size

The contract size of any asset listed on the MT4 and MT5 platforms is measured in lots. Some assets have a minimum contract size of 0.01 lots (1 micro lot), and others have a minimum contract size of 0.1 lots (1 mini-lot). The only exception to the rule is stocks, which are expressed as whole number units. For gold trading on the True Forex Funds evaluation and funded trader platforms, the contract size minimum is 0.01 lots while the maximum contract size for gold trading is 100 lots. You will see the information on maximum and minimum volumes on the platform. The contract size of 1 Standard Lot (1.0 lots) equals 100 troy ounces.

2) Price quotation system

The price quotes for gold are stated in pairs (bid/ask price). However, brokers express gold prices in two decimal places.

3) Unit of price measurement

When we speak of units of price measurement, certain metrics are measured. First, we need to understand the reference to the price changes in the gold asset. Then we also speak of the fractional units of such price changes and the value of the increment or decrement of such price moves. Gold’s price changes are measured in points, not in pips as is the case for currencies. Each point is divided into ticks. The volume increment for gold price is 0.01. Check the MT4/MT5 Market Watch to view the volume increment for each asset.

4) Swap value

What is the swap value? The swap value is the interest payable to a trader holding a higher-yielding asset or paid by the trader as a cost for holding a lower-yielding asset overnight. Gold is a non-interest-yielding asset. Holding gold overnight will actually attract an interest surcharge on your account. In contrast, the US Dollar yields interest according to the prevailing interest rates the US Federal Reserve set. If you hold the US Dollar in an overnight position, you will either receive an interest payment or pay a very small surcharge, depending on your broker.

To view the swap fees that you will incur on any overnight positions held on your favourite asset, you can go to the Market Watch window, or you can use the View -> Symbols pathway to view the contract specifications and the swap values for long and short positions.

- Click View -> Symbols, or press Ctrl + U. A dialog box opens displaying the various asset classes.

- On the MT5, click on the “Specification” tab, then click once on the asset class where your preferred asset is listed. This displays the various assets under a particular asset class.

- Click once on the asset in question and the contract specifications will be displayed. Scroll down the dialog box to “swap long”, or “swap short” to view the swap values for long and short trades, respectively.

- Alternatively, click View -> Symbols. Tap once against the asset class and click the “Show Symbol” tab, then click OK. This action displays all assets within the selected asset class in the Market Watch window.

- Go to the Market Watch window. Right-click on the selected asset, then click on “Specification” in the small dialog box that opens. This displays the contract specifications for the asset. Scroll down and check the “swap long”, or “swap short” to view the swap values for long and short trades, respectively. This is the pathway that works in the MT4 platform, and also represents a shorter pathway for checking the swap values for your selected asset.

5) Trading times

Gold is traded according to the trading times obtainable on the Chicago Mercantile Exchange (COMEX). Gold trading on this exchange opens between 01:00 and 23:59 hours on Monday to Friday, with a 1-hour break each day between 00.00 and 00:59 hours. During the break period, no price quotes are available, and you cannot place orders on the XAU/USD pair. However, existing positions on the XAU/USD will remain valid, and once price quotes are available, the trade’s worth is readjusted automatically.

Points, ticks and pips: different ways of representing price changes

The TFF evaluation and funded trader programs will present various assets to you to trade. If you talk of ticks, points, and pips, you are referring to the various ways of chronicling changes in asset prices. While this blog post will focus on gold whose asset price changes are measured in points, we will also discuss the other terms used to describe price changes in other assets.

- What is a point?

The point is the lowest whole-number change in the price of an asset traded in the futures market. By definition, commodities such as gold and silver will have their price changes measured in points. The emphasis here is on “whole number,” which means the numbers listed on the left-side of the decimal point in a futures asset price quote.

For instance, gold prices changed from a low of 1900.87 at 12:10 hours on 31 January 2023 to a high of 1930.93 at 19:30 hours on the same day. The point change is 30 points (1930 – 1900, the numbers on the left side of the gold price quote).

- What is a tick?

A tick is the lowest fractional change within a point move in an asset traded in the futures market. In other words, a tick is a fraction of a point. The tick is the fractional part of a futures asset price quote. In other words, the numbers on the right side of the decimal point in a gold price quote represent the tick.

The size of the tick differs from one futures asset to another. Gold has a tick size of 0.1, silver and the S&P 500 e-mini index futures have a tick size of 0.25, while the tick size of crude oil contracts is 0.01.

It follows that if you are trading gold, it will take 10 ticks to make 1 point. To use our previous example of the gold price change on 31 January 2023, the tick change is 6 ticks (.93 – .87), which is 0.6 points. So if gold falls from 1913.00 to 1911.34 as shown in the snapshot above, the price change is 16.6 ticks, or 1.66 points.

- What is a pip?

A pip is the smallest unit of price change in a currency pair. A pip is equivalent to 0.0001 points, or 0.01 points in a JPY-pair. Currency prices are expressed to five decimal places, with the fifth place being a tenth of the fourth decimal. A price move of the EUR/JPY from 140.78 to 141.32 is a pip change of 54 pips (141.32 – 140.78 = 0.54). A non-JPY pair, such as the EUR/USD, is priced to four decimal places. So a price change of 1.0870 to 1.0855 is a pip change of 15 pips (1.0870 – 1.0855 = 0.0015).

Calculating the monetary value of Gold’s price moves

Now that you have understood what a point, a tick, or a pip is, the next step is understanding how these price changes translate into money gained or lost from your trading activity. You are on True Forex Funds to make money for yourself and the firm. Given that there are targets and milestones to be met, knowing what price changes will take you to your target is an essential step in your trading process.

The key lies in understanding the monetary value of any point, tick or pip change of the asset you are trading. We will once more use gold as our sample asset.

How is the monetary value of a point or tick in gold trading calculated?

Gold prices are set to two decimal places and are quoted in pairs (bid/ask price). Unlike forex, the contract size of gold is not measured in currency terms but in the unit of measurement of the commodity, which is troy ounces. The Standard contract size for gold is 100 ounces.

- Standard Lot (1.0 lots) = 100 ounces

- Mini-lot (0.1 lots) = 10 ounces

- Micro-lot (0.01 lot) = 1 ounce

How is the tick value calculated? The tick value is the monetary equivalent of a price fluctuation of one tick on a financial asset. Tick values vary from asset to asset.

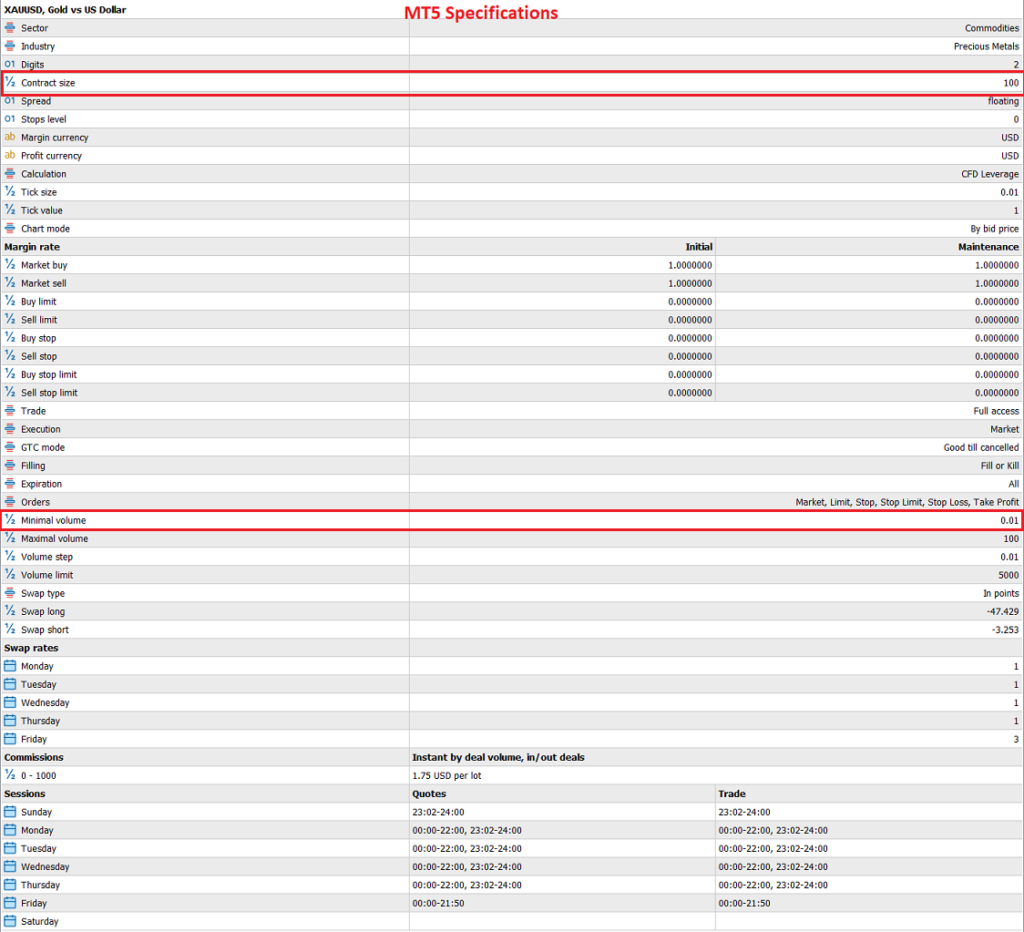

If you are already using the MT4 or MT5 platforms provided by True Forex Funds, go to the Market Watch window on the left of the platform. Right-click on the XAU/USD pair, and click on “Specification.” A dialog box similar to the one below will show.

There are two crucial pieces of data in this snapshot, marked in red. This snapshot was taken from True Forex Funds’ MT5 platform, and shows the contract specifications for the XAU/USD pair. These are used to calculate the tick value for gold. These are the contract size and the minimal volume.

- Contract size: 100 ounces

- Minimal volume: 0.01.

The tick value = contract size X minimum volume

Value of 1 tick = 100 X 0.01 = $1

The value of 1 tick for gold is $1. Recall that it takes 10 ticks to make 1 point for the XAU/USD pair. So the value of a Standard Lot (100 ounces) = the number of ticks in a point X tick value = 10 X 1 = $10.

So the monetary value of a point increment in gold price is $10 if a Standard Lot is traded on the MT5. The same values also hold if your are trading with True Forex Funds’ MT4 platform.

To derive the values for smaller trade sizes, divide the tick value for a Standard Lot in the measure you want to derive. For a mini-lot, you divide the Standard Lot’s tick value by 10, which gives you give $1. A micro-lot by extension will have a point value of $0.1 (i.e. 10/100).

Conclusion

The essence of this article is to present a dimension of trading that is heavily ignored but will have a direct bearing on the trader’s risk management and ability to hit the financial targets set in the True Forex Funds evaluation and funded trader programs. After reading this piece, it is hoped that the trader will have a sound knowledge of contract specifications and how to apply these principles to True Forex Funds’ trading evaluations.