In today’s interview, we have the pleasure of sitting down with Ermir Osmani, a seasoned trader hailing from Kosovo, currently residing in Germany. Ermir has been navigating the trading world since 2016 and graciously shares his insights and experiences.

Ermir, thank you for joining us. Can you tell our readers a bit about yourself and your day-to-day life?

My name is Ermir Osmani, and I’ve been actively trading since 2016. I’m originally from Kosovo but currently live in Germany. In my day-to-day life, trading takes center stage, and I dedicate a significant amount of time to analyzing markets and refining my strategies.

What sparked your interest in trading initially?

Well, some of my friends had ventured into trading, and their experiences intrigued me. I decided to learn from them, and that’s how my journey into the world of trading began.

How did you come across True Forex Funds?

I discovered True Forex Funds through a friend who was already using the platform. Their positive experience prompted me to explore it further.

Let’s delve into your trading strategy. How did you go about building it?

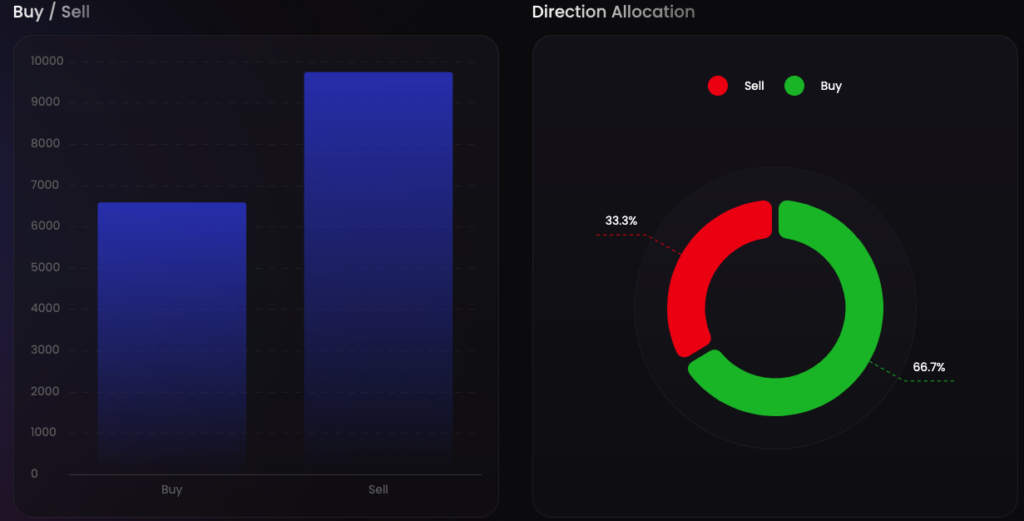

My trading strategy is primarily shaped by insights gained from Albanian mentors. It focuses 99% on the psychological aspect and 1% on technical analysis. I prefer a day-trading approach, with a risk-reward ratio ranging from 1:1 to 1:1.5. I keep my charts clean, utilizing support/resistance, trend lines, and a lot of price action. Analysis is done from higher time frames (weekly) to lower time frames (15 minutes).

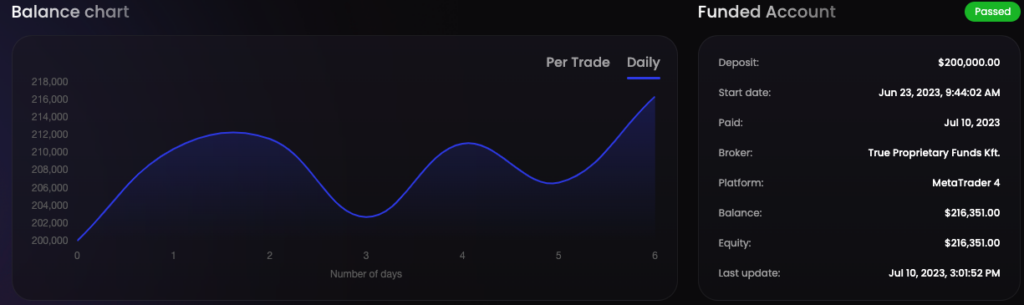

Can you share your recent trading success, like your most recent payout?

Certainly, my recent payout amounted to $13,080.80.

Which trading platform do you prefer, and what currency pairs do you usually trade?

I use MetaTrader 4 on both my Windows PC and mobile. As for currency pairs, I mostly trade EURUSD and XAU/USD.

How do you approach your analysis?

I begin by analyzing higher time frames like weekly and daily to identify trends. Once that’s established, I move to lower time frames to pinpoint entry opportunities. I actually brought some screenshots to illustrate my approach.

Now, let’s talk about the psychological side of trading. Can you elaborate on your approach?

I strictly adhere to some fundamental rules. I avoid overtrading and over-risking. Additionally, it’s crucial not to succumb to the temptation of “revenge trading.”

Finally, what advice do you have for aspiring traders?

My advice, especially for beginners, is not to over-risk and not to overtrade. Take the time to learn the basics, and over time, you’ll naturally improve. Patience and discipline are key.