This article analyzes the factors that determine a currency’s value, shows you the most popular/valuable currencies, and suggests which should currencies should form part of your forex trading portfolio.

I. What is currency?

Currency, Also known as legal tender, is any material or resource that can be used as a medium of exchange between two parties. Currency has transformed over the centuries. Presently, paper notes and coins form the bulk of acceptable exchange media. A few countries have gone ahead to introduce digital forms of their national currencies or have adopted currencies based on distributed ledger technology in addition to their paper banknotes and coins.

In terms of serving as a medium of exchange, currencies must have the following characteristics:

a) Fungibility: currency units must be interchangeable and have a standard weight, character, and look.

b) Durability: Any material used to represent money should be able to last a long time. It must also be difficult to counterfeit.

c) Acceptability: It must be generally accepted by all who use it in society.

d) Recognizable: Money should be easy to recognize.

e) Relative stability in value: The value attached to a paper note or coin should be the same wherever it is used and must not have wide variations in its valuation.

f) Portability: Money must be easy to carry from one point to another.

These days, money is not only an item used as a means of exchange. It is also a commodity that can be bought or sold and whose value is determined by supply and demand dynamics.

For those involved in currency trading, which is where True Forex Funds operates, a currency must also have the following characteristics:

- Its value must be determined by forces of demand and supply and not by government-instigated control.

- A traded currency must be popular and valuable. No one wants to trade a nearly worthless currency that no one else is willing to buy or sell.

- There must be a variation in the exchange rate that is wide enough to create a trading opportunity.

Trading of currencies is done within the virtual global currency marketplace. There is no physical venue, but the market operates via a network of computers, all connected via the Internet. Traders who trade forex and participate in the True Forex Funds funded trader programs can plug into this market using trading platforms that connect the traders to the market makers and execution venues.

Overview of the global currency market and its importance

The world is a globalised village with much interaction between people of different countries and cultures, even without physical movements. How human beings work, live, and play has changed dramatically in the last few decades. People can work online, study online and also participate in global gaming communities, all from the comfort of their homes. The world is also emerging from a pandemic that radically altered several aspects of daily human activity and interaction. Most of these activities involve the exchange of value, which must be paid for using currency.

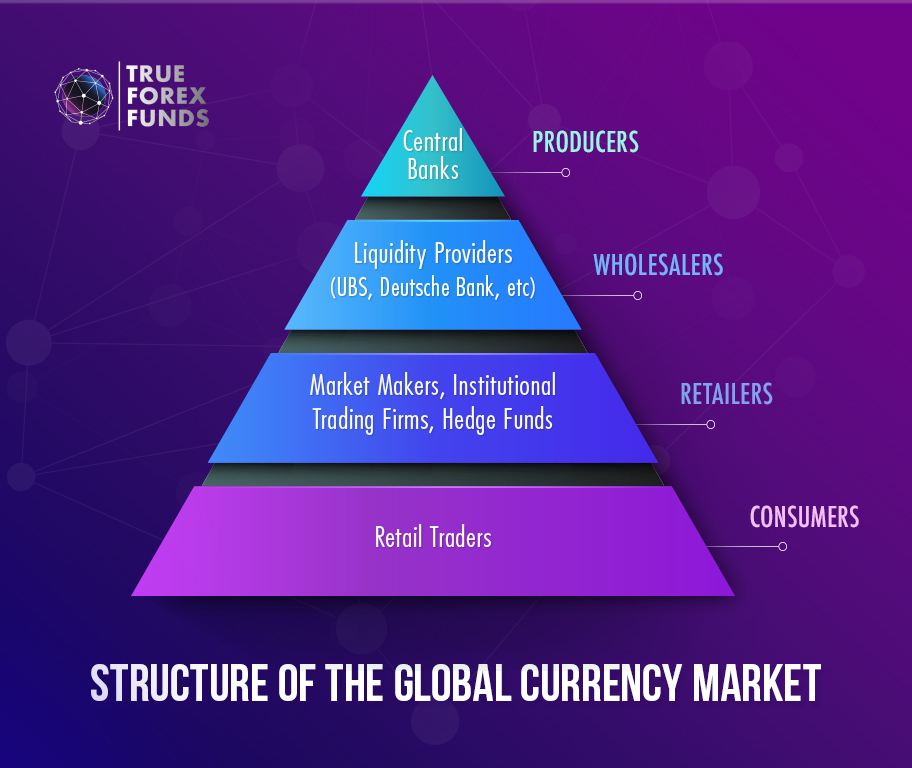

In addition to just being a medium of exchange, currencies have become a tool for making money via trading. We now have a global currency market in place, where central banks print money, made available to several players in the societal cadre and used by everyone for various means. You can view the global currency market operators from the supply chain prism, where there are producers, wholesalers, retailers, and consumers.

At the producer end, there are the central banks. They print the global currencies and provide them to the banks that serve as liquidity providers in the global interbank currency market (wholesalers). The liquidity providers then serve the retailers, comprising the prime brokers and market makers. This segment is also where you find institutional trading firms. The retail traders comprise the market’s consumer section, and the market makers primarily serve them.

The chart simplifies the entire structure of the global currency market. The global currency market powers all human activity where value is exchanged and therein lies its importance. Of course, there is the everyday offline use of forex for all kinds of commercial activity. In this instance, the central banks are on top, the commercial and deposit money institutions are in the middle, and the country’s citizens and visitors who come in occasionally are the consumers.

What determines a currency’s value or popularity?

A currency’s value or popularity is determined by the extent to which that currency is demanded or sought after by traders, investors and everyday users.

1) If a currency has international acceptability, that currency will be popular and it will also be assigned an inherent value.

For instance, the US Dollar is the standard currency of international trade. Commodity prices are expressed in US Dollars, and the greenback also serves as an intermediary currency of exchange when it is not possible to exchange two currencies directly. For instance, you may not be able to buy the South Korean Won with the Barbadian Dollar. But a Bajan tourist can buy the US Dollar with the Barbadian Dollar and subsequently exchange this for the Won when they land at the airport in South Korea.

2) If a country has investment vehicles in place for international investors or has an enabling business environment that can attract foreign capital, that country’s currency will be popular and valuable.

This is the reason behind the listing of so many foreign companies on the US stock exchange. It is also why foreign investors are heavily represented in the US Treasuries market. To be able to buy US government bonds, a foreign investor must exchange their currency for the US Dollar to finance those purchases. In the same vein, students who wish to attend UK universities or universities in Malaysia, the US or other countries with a sound educational system must be able to convert their local currencies to the British Pound, Malaysian Ringgit, US Dollar, or whatever currencies need to be acquired to finance the educational endeavour.

3) If a country has favourable banking laws and has a safe-haven or reserve-currency status, the currency would be one of the most valuable in the world.

This is why the Swiss Franc remains a favourite of investors for capital protection during a global economic meltdown. It also has a status of a reserve currency as it is one of the world’s most stable currencies.

These are not the only factors that determine the popularity of a currency or how valuable a currency is. But they give an idea as to what drives people to demand a currency and make it popular or valuable.

II. Most Valuable Currencies in the World

Is there any such thing as the most valuable currency in the world? The answer is that there is. All currencies are not created equal. Certain currencies are deemed more valuable in the scheme of global economics, either because they have higher purchasing power in specific regions or possess characteristics that make them more desirable to traders and everyday users. For instance, the US Dollar is deemed one of the world’s most valuable currencies simply because of its role in international trade and finance.

One of the fallouts of the Bretton-Woods Conference of 1944 was that the US Dollar came to be the international currency of trade. All commodities are priced in US Dollars; gold, crude oil, natural gas, copper, platinum, palladium, and other metals are expressed in US Dollar prices.

Travel from one region to another, especially if you come from outside of the EU and North America. You will find that you would need to carry the US Dollar with you before you can purchase the currency of the destination country. Before Brexit, there was a large influx of workers from Eastern Europe to the UK because the Pound had better purchasing power than several of the individual currencies of EU countries that had not yet signed up to use the Euro.

If you go to many parts of Africa and Central/South America, the US Dollar has a purchasing power that beats the local currencies. This is also a factor driving the migration of American citizens to places like Mexico, Brazil, and other exotic South American locations. All these instances show situations where the value placed on certain currencies drives trade, migration, and tourism.

Other factors drive a currency’s popularity and store of value. In the currency markets, some currencies are known as reserve currencies. These currencies can withstand the vagaries of the global economy because of the global standing that the economies that own these currencies possess. For instance, the Swiss Franc is a safe-haven currency that attracts demand during economic upheavals. This is because of the strength of that country’s economy and, more importantly, its status as a home to the money of the world’s rich via its banking system.

Factors that Determine a Currency’s Value

Have you ever had a look at the economic news calendar? All the macroeconomic data listed are factors potentially affecting a currency’s value. That is why millions of traders worldwide and thousands of institutional firms trade the news.

The news provides insight into the state of a particular sector of a nation’s economy. This will ultimately determine if the nation’s currency will attract demand or will be offered in the global currency market. But it is not all about economics. Political and social factors will also come into play to determine if traders will buy or sell a currency. Here are the most critical factors that determine a currency’s value.

At this point, it is essential to state that macroeconomic data do not have the same weighting. What may move the markets today may not move the markets tomorrow. In the period post-2008, housing data were the major market movers because a housing sector problem triggered that crisis. When the COVID-19 pandemic came, a new set of economic data became the new market movers. You should always know what moves the market most at any given time. Some of these have been covered in the article on Economic News with the Highest Potential in 2023.

In a nutshell, these are the macroeconomic data that affect a currency’s value:

- Interest rates

- GDP (economic growth)

- Employment (NFP & ADP in the US, UK Claimant Count, Unemployment rate, etc)

- Retail sales data

- Purchasing Managers’ Indices for the manufacturing and services sectors and comparable data worldwide.

- Inflation data (consumer price index, producer price index).

Please refer to the article in question to get a detailed perspective of what economic data you should be trading in 2023 for the True Forex Funds funded trader programs.

Overview of the Top 6 Most Valuable Currencies

What are the most valuable currencies in the world? For this piece, we use the latest Forbes definition, which indicates currencies that can buy the most US Dollars using 1 unit of that currency. Using this metric, the top 6 most valuable currencies are listed below.

1. Kuwaiti dinar (KWD)

Most will remember Kuwait as the country invaded by Saddam Hussein in 1990, triggering the 1991 Iraq war. Kuwait is an oil-producing nation, and its currency is the Kuwaiti Dinar. This currency is the world’s strongest as it can purchase 3.26 US dollars.

2. Bahraini dinar (BHD)

Bahrain is another oil-producing country located in the Middle East. The Bahraini Dinar (BHD) is used here, and it comes into the second position as 1 Bahraini dinar buys 2.65 US dollars.

3. Omani rial (OMR)

Oman is yet another oil-producing nation in the Middle East. The Omani Rial (OMR) is used here and ranks as the world’s third-strongest currency. 1 OMR will exchange for 2.60 US dollars.

4. Jordanian dinar (JOD)

The Middle East country of Jordan uses the Jordanian Dinar. With 1 unit exchanging for 1.41 US dollars, the JOD is the 4th most valuable currency in the world.

5. British pound (GBP)

The Pound Sterling is one of the world’s oldest currencies, having been around since the 1400s. It has shaken off its recent plunge and has crept back up the rankings as the fifth-strongest currency in the world. It is also the first in this list that is free-floating and is not USD-pegged. Currently, 1 Pound can purchase 1.25 US dollars.

6. Cayman Islands dollar (KYD)

The Cayman Islands is a popular tax haven for the world’s richest individuals. So it is little wonder that its currency is considered more valuable than the US Dollar. It is also one of the most expensive locations to live in. One unit of the Cayman Islands Dollar buys 1.20 US dollars.

III. Most Popular Currencies in the World

This section introduces the most “popular” currencies in the world. When the word popularity is mentioned, it connotes something everyone knows and wants. There are some currencies whose names you hear and at first glance, would scratch your head as to what the name is all about, let alone associating the name with a currency. But others are known everywhere in the world. For instance, the $US100 bill, which carries the portrait of Benjamin Franklin, is one of the most recognizable notes on the planet. This immediately tells you that the US Dollar is a popular currency.

Definition of what is a popular currency

The definition of a popular currency will differ when you speak to the everyday person on the street and when you speak to a forex trader. What may be popular for the average Joe may not be famous for a forex trader.

To a layman, a popular currency is one which has wider acceptability among the populace, be it a local currency or a foreign one. For instance, the US Dollar is the most popular currency in many parts of the world. As of the last check in 2018, 27 countries used the US Dollar as legal tender, either as a sole currency or a second and even third currency. The US Dollar is the most accepted reserve currency as it is a global currency of trade, transactions, and exchange. The fact that most US Dollar notes in circulation are held outside of US borders makes it the most popular currency.

But when it comes to the most popular currencies for trading, which ones constitute the most valuable currencies in the world for forex traders?

- US Dollar (88.5% of all FX trades)

- Euro (30.5% of trades)

- Japanese Yen (16.7% of all FX trades)

- Pound (12.9% of all FX trades)

- Chinese Renminbi (7%)

- Australian Dollar (6.4% of all trades)

- Canadian Dollar (6.2% of all trades)

According to the 2022 Triennial Survey by the Bank of International Settlements (BIS), the first four currencies in the list have maintained their positions as the most traded currencies by turnover from the last survey done in 2019. The Chinese Yuan Renminbi has made a remarkable jump from 8th place in 2019 to being the 5th most traded currency in the world. With the latest moves by the BRICS countries to shift away from the greenback as the currency of trade settlements, the Yuan is suddenly gaining increased prominence to become a most valuable currency regarding global economics.

The Rise of Digital Currencies As a Popular Alternative

Fiat currencies are no longer the only popular currencies in the market. There are now digital currencies in place, made popular as people start to express dissatisfaction with the conventional banking and financial systems which operate with centralized control. The alternatives are built on decentralized ledger technology (the blockchain), and we now have several popular digital currencies. Bitcoin and Ethereum are the most popular of this new class of currencies. It is no surprise, the 2023 collapse of several banks worldwide has reawakened interest in this new currency class, with Bitcoin once more being the toast of crypto traders and investors worldwide.

Is value = popularity?

No. The Yuan is getting more valuable with time, but it is not the most popular. Walk along the street and ask ten tourists you come across if they hold Chinese Yuan Renminbi notes. You are likely to have differing answers. But ask them if they hold the US Dollar or Euro. You are more likely to find that nearly every tourist holds US Dollars. The USD is popular, and it is valuable. The Yuan is valuable, but it is not popular.

Advantages and Disadvantages of Using Popular Currencies

There are advantages and disadvantages to using popular currencies. What are they?

Advantages

- Using a popular currency prevents speculative attacks on local currencies, some already weaker than the popular currency by default.

- The use of a popular foreign currency promotes inflows of foreign capital. The practice of using popular currencies attracts foreign investment into a country. Investors want to know that they can repatriate their earnings in foreign currency when they do business in an emerging economy that uses a popular and local currency.

- A popular and stable foreign currency can also help locals protect against exchange rate risk events. Some people like to park their funds in popular foreign currencies to hedge against the local currency’s devaluation.

Disadvantages

- Using popular currencies in countries with weaker local currencies could cause spiraling inflation. This is because providers of goods and services will tend to ask for payments in popular currencies, forcing prices upwards. This is being seen in many African countries where the US Dollar is used along with weaker local currencies, a phenomenon known as “dollarization” of the economy.

- A country that uses a popular foreign currency at the detriment of its own local currency is opting to use a currency whose money supply it does not control. This leads to the inability to enact appropriate monetary policy and loss of seigniorage (profit realised from issuing coinage at lower costs than the coins’ actual value). Using a popular currency means that such seigniorage profits go to the government printing the popular currency, not the country where it is used.

- The banking systems of a country using a popular currency along with a local one will become more vulnerable to distress since that country’s central bank will lose its ability to function as a lender of last resort. This also means that the government in question will be unable to offer stimulus (as occurred during the pandemic), as it cannot print a currency it does not own.

Are there any less popular currencies that retain their value over time? Several examples of less popular currencies have managed to retain their value over time. These are the Singaporean Dollar, Hong Kong Dollar, Chinese Yuan, South African Rand, and the Scandinavian Crown currencies. These currencies are either under fixed or managed float systems or are currencies of the leading emerging market economies which undergo bid-offer cycles in response to rising or falling interest rates in the developed economies.

Less popular currencies are generally not good investments in a time of recession. Currencies that work best during recessions are stable currencies that serve as safe-haven currencies. In a recession, the investor aims to protect investments and not necessarily to grow them. Less popular or valuable currencies do not work well in preserving investments as they are generally subject to greater exchange rate risks.

IV. How to Get Started in Trading Foreign Currencies

The main aim of the information in this article is to prepare you to take on the True Forex Funds funded trader programs, designed to provide good traders with the capital they need to take their trading to the next level.

Overview and main benefits of True Forex Funds

True Forex Funds is a proprietary trading firm that provides enhanced capital to experienced traders who successfully pass the 2-stage evaluations and become eligible for such capital. Funding on True Forex Funds starts from $10,000 and extends to $400,000. The 2-stage evaluations start by paying a fee of 89 euros for a $10,000 account. Larger account sizes attract higher fees. Once a trader has passed the evaluations and is now a funded trader, the fees are refunded along with the first profit split. Spreads on trades are as low as 0.0 pips, providing you with institutional trading conditions.

The benefits of trading with True Forex Funds are as follows:

- You get exposure to a wide array of markets and you can trade what you want.

- You can hold positions overnight.

- You can trade the news.

- Registration fees are refunded to those who have reached the profit-split milestone as a funded trader.

- The drawdown rules are more relaxed than with other prop firms.

- You can access up to $400,000 capital to manage once you pass the 2-stage evaluations and prove yourself in the funded trader stage.

The registration process is straightforward, and you are only required to verify your identity after you have qualified to get funded. The profit split is 80/20, with the trader taking home 80% of all profits.

V. Conclusion

This article has highlighted the world’s most popular and valuable currencies today. It has also distinguished those currencies in the two lists that meet the conditions for being traded in the forex market.

If done correctly, trading the fundamentals of the most valuable and popular currencies listed in the forex market is a major way to make money from forex. Therefore, there is a need for an ongoing study of how to interpret and apply these fundamentals to your forex trading. It is essential to understand the drivers of the price movements of these currencies, as they will enable you to trade the news effectively.

FAQ

What are the most popular currencies in the world for trading?

US Dollar, Euro, Pound Sterling, Japanese Yen, Canadian Dollar, Swiss Franc, Australian Dollar, Chinese Yuan and New Zealand Dollar

What are the most valuable currencies in the world?

US Dollar, Euro, Pound Sterling, Kuwaiti Dinar, Canadian Dollar, Swiss Franc, Omani Rial, Bahraini Dinar

What are the most valuable currencies that are stronger than the US Dollar?

Kuwaiti Dinar (1 KWD = 3.26 USD), Bahraini Dinar (1BHD = 2.65 USD), Omani Rial (1 OMR = 2.60 USD), Jordanian Dinar (1 JOD = 1.41 USD), Pound Sterling (1 GBP = 1.25 USD).

What are the major trading currencies?

US Dollar, Euro, Pound Sterling, Japanese Yen, Chinese Yuan, Swiss Franc, Canadian Dollar, Australian Dollar, New Zealand Dollar.

Is it possible to trade the most valuable currency in the forex market?

Since the most valuable currency (Kuwaiti Dinar) is pegged to the US Dollar, it is not free-floating and therefore does not fulfill the requirements for being traded in the forex market. In the list of the top 10 most valuable currencies, only the Pound, Euro, and Swiss francs meet this requirement.

Can I invest $100 in forex?

$100 is too small an amount to trade forex with. You will be better served using that money to register for True Forex Funds’ $10,000 evaluation account. If you pass the 2-stage evaluation, you will have $10,000 real money to trade with. This is a healthier account size that can survive the vagaries of the forex market if risk management is used. Register for the 2-phase evaluation with True Forex Funds today.