George Soros, a remarkable trader and billionaire with Hungarian-American roots, has achieved astounding success in the financial world. His trading techniques and ability have led him to accumulate a staggering fortune of 25.7 billions. Notably, Soros’s historic trade earned him the title of “The Man Who Broke the Bank of England” during the 1992 Black Wednesday crisis. This event marked the start of a series of other wins in his forex trading journey. Despite occasional losses, George Soros consistently rebounds thanks to his investment philosophy and trading strategy. So, what exactly is “The Soros Way” of trading? Let’s dive in and explore!

Investment Philosophy: Reflexivity Theory

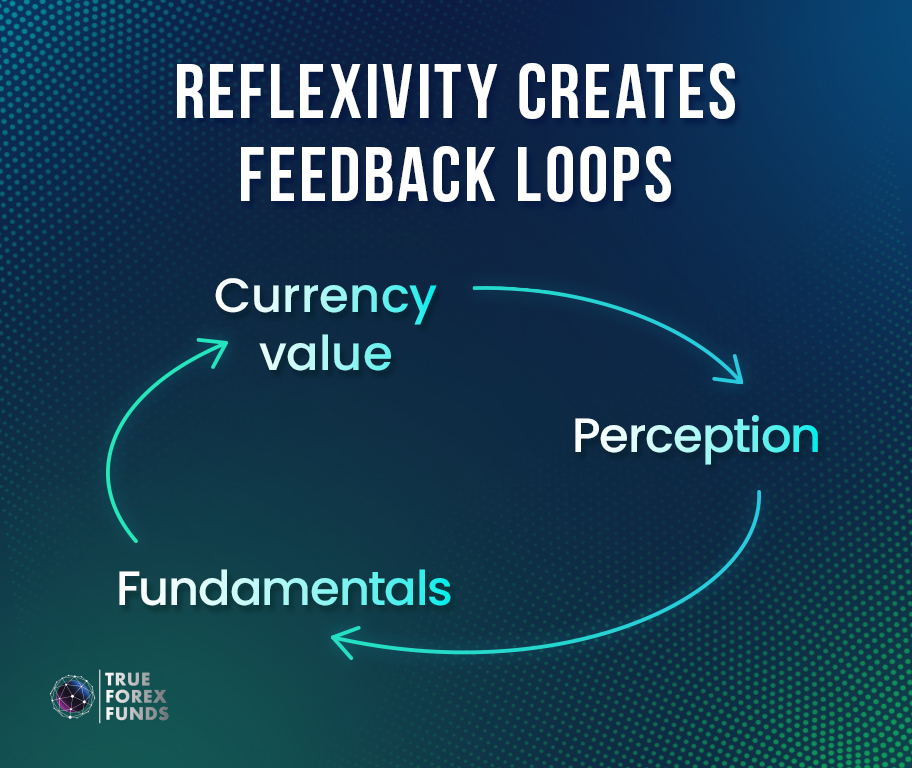

At its heart, reflexivity theory suggests a dynamic relationship between investors’ perceptions and economic fundamentals, resulting in a feedback loop that influences market trends. Reflexivity introduces the idea that perceptions can shape economic reality and vice versa. Hence, it evokes a contradiction to the conventional economic theories that assume a straightforward cause-and-effect relationship.

Characteristics of Reflexivity Theory

There are five key characteristics of the reflexivity theory:

- Positive Feedback Loop: Central to Soros’s theory is the presence of a positive feedback loop. Market prices, investor expectations, and economic fundamentals are intertwined in a way that changes in one element trigger reactions in the others. This feedback loop intensifies trends and amplifies market movements, often leading to momentum-driven price shifts.

- Imperfect Reflection of Reality: Soros argues that human perception of reality is inherently imperfect due to cognitive biases, emotions, and limitations. This imperfection influences how market participants interpret events, often distorting their understanding of underlying economic realities and perpetuating market distortions.

- Influence of Uncertainty: As a result of the reflexive nature of investor behavior, markets are inherently prone to volatility and instability. Small changes in perception or sentiment can lead to significant shifts in market conditions. This can cause prices to diverge from their intrinsic values, and potentially sparking wide-ranging market swings.

- Market Participants’ Impacts: Reflexivity theory suggests that market participants hold significant influence over market conditions. For example, if a group of investors collectively believes that a currency’s value will increase, their actions can lead to a self-fulfilling prophecy. This can drive up the currency’s price irrespective of its underlying fundamentals.

- Adaptive Behavior: Given the reflexive nature of markets, Soros underscores the importance of adaptive behavior among market participants. By recognizing the feedback loops at play, traders and investors can adjust their strategies to align with changing perceptions, mitigating risks associated with volatile market dynamics.

How Did He Break the Bank of England?

George Soros’s success in breaking the Bank of England during the Black Wednesday crisis illustrates his reflexivity theory. Recognizing a positive feedback loop, he capitalized on traders’ perceptions of the British pound’s weakness triggering selling. This intensified doubts, driving down the pound value beyond its actual worth. Market sentiment, influenced by biases, led to an unstable situation where the pound’s value was detached from reality.

George Soros: Trading Strategy in Forex Trading

Centralized around reflexivity theory, George Soros’s trading strategy in Forex trading exemplifies the practical application of this theory in navigating the complexities of the financial markets. Here are the fundamentals of Soros’s Forex trading strategy:

Active Money Management

Soros believes in active money management. He argues that most traders make the mistake of holding on to their positions for too long, hoping that the market will turn in their favor. However, successful traders should be proactive in managing their positions, cutting their losses, and taking profits when the opportunity arises. As he famously said,

“It’s not whether you’re right or wrong that’s important, but how much money you make when you’re right and how much you lose when you’re wrong.”

Global Macro Strategy

Soros is known for his global macro strategy, which involves analyzing the global economic landscape to identify trading opportunities. While many other traders focus on specific stocks or currency pairs, Soros looks at the big picture. He analyzes macroeconomic trends and factors that could impact currencies, such as changes in interest rates, inflation, and geopolitical events. Focusing on global macro helps Soros to identify long-term trading opportunities that could generate significant profits.

Short-Term Speculation

Soros is famous for his short-term speculation strategy. He believes that the markets are unpredictable, making it challenging to know exactly when a trend will change. Therefore, he takes advantage of the bear market to generate quick profits. Soros isn’t afraid to go against the trend and take contrarian positions. He believes that this approach can yield significant returns if executed correctly.

Technical Analysis

Soros combines his fundamental analysis with a technical analysis approach. He uses technical indicators such as Moving Averages, Relative Strength Index (RSI), and Bollinger Bands to analyze price trends. Soros also uses chart patterns to analyze the market and make informed trading decisions. While many traders solely rely on technical analysis, Soros sees it as simply another tool to aid his decision-making process rather than the key driver behind his trading decisions.

Great Capital and High Leverage

Employing substantial capital and leveraging it effectively is crucial due to his focus on capitalizing on market inefficiencies and short-term trends. By using large amounts of capital, Soros aims to magnify potential profits from market movements and the forex volatility. High leverage allows him to control larger positions with a relatively smaller initial investment, enabling him to take advantage of even minor fluctuations in currency pairs.

Let’s get started with our great capital resource!

Get fundedLessons from George Soros: Philosophy and Trading Strategy

George Soros’s philosophy of reflexivity not only encourages thinking outside of the box but also advocates people for ambition and self-assurance. As he eloquently puts it,

The markets are always on the side of exuberance or fear. It’s fear and greed. Right now greed has the better of it, which is rather nice (for investors) as long as it doesn’t get out of hand.

While starting with just a few hundred dollars can yield modest returns, the potential magnifies when you operate on a larger scale. Hundreds can bring more hundreds, and thousands can bring more thousands.

However, we recognize the challenges while investing with a substantial investment

That’s where TrueForexFunds comes in to bolster your confidence! For just $89, we open the door to a $10,000 balance account. We would like to provide you the assurance you need to seize opportunities with newfound vigor, and fulfilling your trading aspirations.