What’s the Difference between forex trading and stock trading? Which is More Profitable? Find out how forex and stock trading began and how it changed through the decades. We’ll explain why forex trading can be more profitable than traditional stocks.

I. Introduction

What is forex trading, and how is it different from stock trading?

Forex trading is the buying and selling of currencies, aiming to profit from the continuous fluctuations in the value of the exchange rate between two paired currencies. On forex broker platforms, it is common to find more than one hundred currency pairs available for trading in the forex market.

II. History of Stocks

What are the origins of stocks, stock markets, and forex trading?

The stock market is one of the oldest financial markets in the world. Stock trading is several centuries old. Records of the earliest stock trades go back to modern-day Belgium. However, we must look toward Amsterdam, Holland, where the first stock trading activities that resembled the present-day stock trades were performed for the first time in 1911. Stock trading eventually reached the US in 1790 when the Philadelphia Stock Exchange took off.

Stock trading in these times was purely exchange-based. You had to buy the stocks of the companies you wanted physically and take physical ownership of the documents proving your ownership of these shares. You only made money if the value of the shares appreciated from the purchase price. This form of stock trading required the physical assembly of clients’ orders for onward transmission to the trading pits for execution. This “open outcry” system eventually gave way to electronic trading systems and platforms in the mid-90s.

The deregulation of the forex market and the technological advances that included new interactive trading platforms gave birth to a new form of stock trading known as CFDs (Contracts for Difference). These stock CFDs allowed traders to buy or sell contracts based on underlying stock price movements. Not only could traders profit from falling prices using sell orders and rising prices with buy orders, but it was also now possible to trade stocks with leverage. On many forex platforms, stocks are offered for trading as CFDs. Some of these are listed on the MT4 and MT5 platforms where the True Forex Funds Funded Trader evaluations are held.

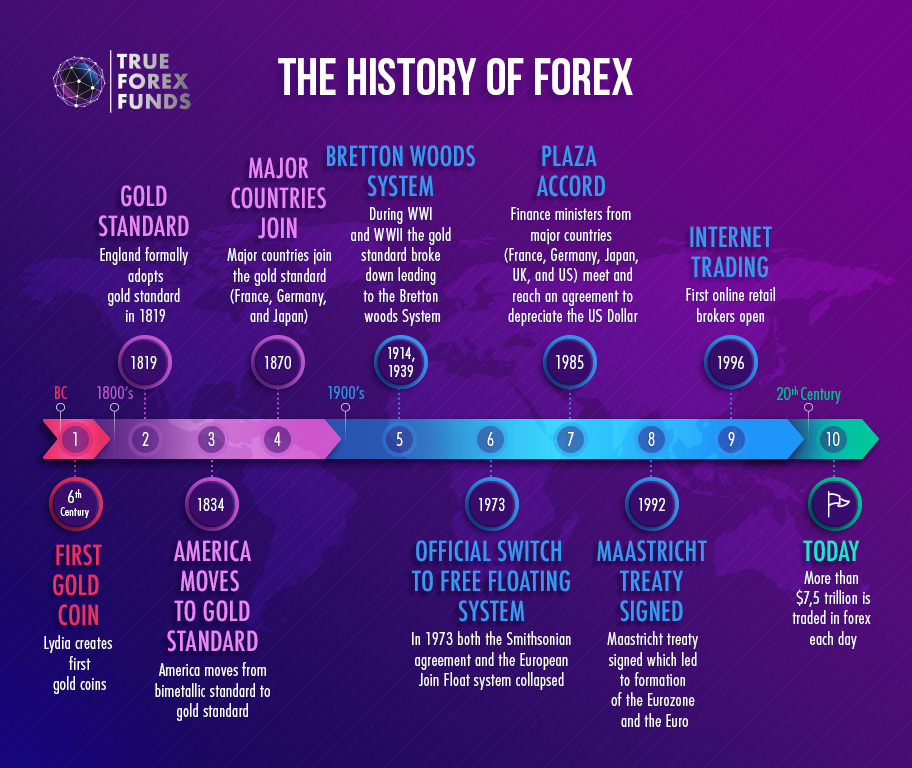

Origins of Forex Trading

Forex trading came on board much later than stock trading. Forex trading started at the institutional level after the US government decided to de-peg the US Dollar from gold prices. The gold peg had been introduced in 1944 as a fallout from the Bretton Woods Conference, held in New Hampshire, to discuss the future of a post-World War 2 global economy.

Following this 1971 decision by the government of US President Richard Nixon, the US Dollar began to “float” as the forces of demand and supply solely determined its value. Other global currencies followed suit, and by the 1980s, there was a fully functional currency trading market. However, this market was only populated by banks and institutional-level clients, as it required considerable liquidity to keep it operational. The banks were the only institutions that could provide such liquidity, along with hedge funds and high net-worth individuals. It was not until 1997 that the forex market was deregulated, and retail participation in the forex trading market became possible. This development became possible due to the emergence of market makers who could source foreign exchange from the banks and liquidity providers while reselling these in smaller volumes to individual traders.

Today’s forex market is much deeper than in the 1980s, 1990s, or even 2000s. A lot of evolution has taken place. One of these evolutions is the emergence of prop trading firms like True Forex Funds, which now allow skilled traders to get evaluated and trade the forex market with enhanced capital pools.

III. Forex Trading Overview

What are the benefits of forex trading over stock trading? Forex trading has some benefits over stock trading. Here is a summary of some of these benefits.

a) Higher Leverage

Forex trading allows traders to operate with higher leverage for trading. This factor reduces the capital requirements for executing trades in the market. If you were to trade forex on the True Forex Funds evaluation programs, your forex leverage would be 1:100 (one hundred times buying power). Leverage for stocks is lower. Imagine getting access to capital of up to $200,000 with a leverage of 1:100 to trade any of your favourite currency pairs. This gives you a maximum buying power of $20 million! This is why True Forex Funds encourages its clients to be as active in the forex pairs as possible, as the immense buying power could potentially give a good trader a comfortable cushion to trade and hopefully make good profits.

b) Lower Trading Costs

The costs of trading forex are generally lower than trading stocks. This is due to the higher liquidity of the forex market relative to the stock market. Also, CFD stock trading comes with commissions and larger trading spreads, which give forex traders an advantage in lower costs.

c) Higher Liquidity

The forex market is the most liquid financial market in the world. According to the Bank of International Settlements 2022 triennial survey, forex market turnover is now at a record $7.5 trillion daily. This figure far outstrips the daily turnover of the New York Stock Exchange (the world’s largest and most capitalized stock market).

As of July 2022, the Chicago Board of Exchange (CBOE) reported that the daily turnover in the

US stock markets (NYSE, NASDAQ and CBOE) was about $460 billion dollars. This is about 20 times less than the average daily turnover in the forex market and gives you an idea of just how huge the forex market is.

d) 24/5 Trading

Different stock markets have their specific trading times. The forex market is open for trading 24/5, round-the-clock between Sunday at 10 pm UTC and Friday at 10 pm UTC. In contrast, stock markets have specific trading hours outside of which trading cannot occur. They are not 24-hour markets.

e) Enhanced Volatility

The forex market is more volatile than the stock market. Volatility presents trading opportunities, so it follows by extension that the trader will be presented with more trading opportunities in forex than in the stock market. This volatility factor can make the difference between profitable trading and losing trades for scalpers and day traders. Enhanced volatility allows scalpers and day traders to open and close their positions quickly and still have the potential to walk away with good profits. The fact that the forex market operates on a 24-hour basis also helps to produce several windows of volatility within a trading day. This is unlike the stock market, where the windows of volatility are usually limited to the market opening and the last hour of the trading day.

The risks and potential rewards of forex trading

The risk every forex trader faces is that you can more easily lose all your money than in traditional exchange-traded stocks. This comes from the fact that forex is leveraged currency trading based on contracts for difference (CFD). CFDs are financial instruments that allow you to buy or sell contracts based on the price change of the underlying asset without owning any of the assets involved. So when trading forex, you do not hold or exchange the physical currencies. You are only purchasing contracts based on price differences. Since these are leveraged contracts, you must possess enough capital (margin) to keep your leveraged trades open. You will be issued a margin call if the trades reverse against you to a specific price, known as the stop-out level. A margin call is an instruction from the broker to the trader to put in more capital to sustain your trades immediately, or the trades will be closed automatically to protect the broker’s margin. So it differs from offline trading of currencies in the Bureaux de Change offices, where the operators can afford to keep their currencies indefinitely until rates improve. In forex, trades that are moving in a direction that is contrary to your expectations are a risk factor, and unless your account is appropriately capitalized to handle such a risk event (which could happen), you could be in trouble.

A well-capitalized account provides you with a certain cushion against such risk events. Of course, there is still a responsibility on your part to use acceptable risk exposure limits, or that even if trades go against you, a margin call will not come your way. This is why you need to trade forex with True Forex Funds as you can access a lot of capital to trade after passing the 2-stage evaluation.

But what if the trades go your way? Some people have used forex trading to ride out the financial storm that came with the pandemic. Some have bought cars with their forex profits, while others have built houses and sorted out healthcare issues. A select few have also made forex trading their full-time income earner. That’s how profitable forex trading can be if you get it right and access enhanced capital via True Forex Funds’ Funded Trader programs. It brings a good feeling of accomplishment and puts money into your pocket that can take care of some expenses of yours.

The importance of education and a solid trading plan in forex trading

There has been a significant uptick in forex education by brokers in the last 3-5 years. In some jurisdictions, regulators mandate brokers to provide trader education for their clients. Forex trading is a knowledge-based and skills-based endeavour. The ability to establish the factors at play in increasing or reducing the exchange rate of a currency pair and using these factors to call price direction accurately requires knowledge and skills. These can only come from acquiring theoretical and practical knowledge. All these will have to align to develop a solid trading plan.

What is a trading plan? As far as trading is concerned, a trading plan has to cover the following:

- How much risk to assume per trade.

- Making correct entries and exits to make a profit.

- What to do if trades go south.

- Going back to losing trades and finding out what went wrong.

- Sometimes, tweaks to the trading system, your setups, or improving your broker’s latency.

These lessons are encapsulated in the life and career of one of the most successful forex traders of this generation: Bill Lipschultz. Ranked among the top 5 forex traders in the world at one point, Lipschultz started trading with 12,000, turned it into $250,000 in profits, and then lost it all due to a lack of proper risk management. He devised his concept of risk and reward, aiming to be right “only 20 to 30% at a time. This concept was based on allocating a risk-reward ratio that ensured that getting three trades out of ten would still leave him in profit. When he left Solomon Brothers trading firm after six years, he had been effortlessly making $300 million a year for the firm.

This shows the importance of having proper trading education and trading plan. Every plan must have room for a risk management strategy.

IV. How to Start Forex Trading

To start forex trading, you need the following:

- A forex trading account

- Government-issued identification documents (international passport, drivers’ license or national ID card)

- A payment channel (for transferring your capital to the broker and withdrawing any profits).

- Capital to trade with (which is where True Forex Funds comes into play).

Gone are the days when you had to struggle to put together a few hundred dollars to start forex trading. Accounts that house hundreds of dollars will not only produce a minimal opportunity for making any reasonable profit but also make trading hard work and overly burdensome. The same effort it takes to make 10% of a $200 account is the same level of effort you would have to put in to make 10% of $100,000. Ten percent is ten percent. The big question is: 10% of what? Would you instead be aiming for 10% of $200 or $500, or would you be aiming for 10% of $50,000, $100,000 or $200,000?

A way to start your forex trading journey on a solid footing, with a well-capitalized account and access to several resources available in the MQL Community, is by enrolling in the True Forex Funds funded trader programs. Here is what you can expect when you get started with True Forex Funds.

Overview of the True Forex Funds platform, challenges and tools

TrueForexFunds is like a one-stop shop that enables the forex trader to kickstart a trading career. Traders can participate in evaluations to become well-funded traders. To participate in the evaluations, traders must purchase evaluation accounts denominated in Euros, Pounds and US Dollars. Only after passing the two stages in the True Forex Funds evaluation process are traders required to provide ID documents to get verified.

This process represents a simplification of the entry barrier into the forex market, as you do not have to focus on providing the ID documents initially. The aim here is to make it easy to have a smooth and fast registration, and then start trading immediately without any distractions. Focus all your energy into passing the 2-stage evaluations and get funded before you get verified.

To become a Funded Trader at True Forex Funds, you must pass a 2-step evaluation program. Passing the program entails hitting the stipulated profit targets and not flouting the drawdown rules (explained here).

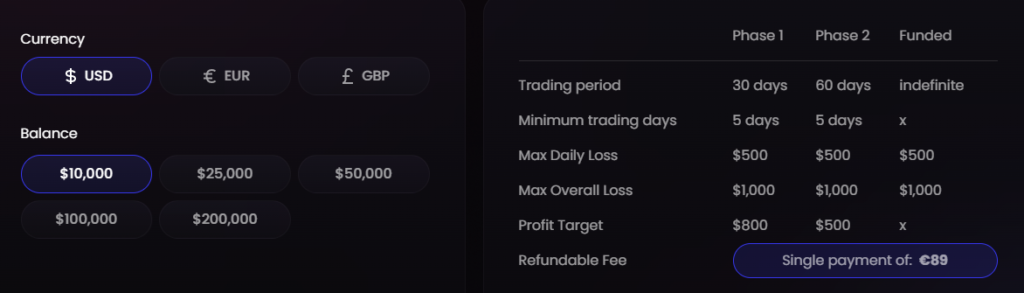

Phase 1 has an 8% profit target and requires you to trade for at least 5 days. You have 30 days to pass the challenge. You are allowed a 10% maximum overall loss or a 5% daily loss limit. You only have to pay a marginal registration fee of 89 euros to get the entry level Phase 1 account of $10,000. Accounts with higher capital can be accessed as well, with registration fees as follows:

- $25,000: 189 euros

- $50,000: 299 euros

- $100,000: 499 euros

- $200,000: 998 euros

You are granted free retries if your account balance remains positive, you did not violate the loss limits, and you have reached the trading period limit.

After passing Phase 1, Phase 2 comes calling. You have to attain a 5% profit target, but you have 60 days to do this. You must trade for a minimum of 5 days, and you are allowed a 5% maximum daily loss and a 10% maximum overall loss. This stage is free.

Once you pass Phase 2 successfully, you are allocated substantial capital for trading. Profits are split in an 80/20 sharing ratio, with 80% going to the trader and 20% to True Forex Funds. You get a refund on the registration fee with your first profit split and no trading period limits. There are no minimum trading days for funded accounts. You must still conform to the 5% maximum daily loss and 10% maximum overall loss rules.

Importance of understanding trading costs and spreads

The trading costs a participant in forex trading will incur are spreads and commissions. These are deducted upfront whenever a trade position is opened. If you are a scalper or day trader, you must understand your trading costs and how they will impact your profitability. If you are a swing or position trader, you should also understand that you will incur an additional cost: rollover fees. Rollover fees are charged on an account with overnight positions. These costs increase with larger lot sizes and more open positions. Some assets also attract overnight positions that could accumulate and become more significant than the profits being sought.

Currency pairs, metals, stocks and cryptos all come with different spreads and commissions. In addition, you can also get the standard True Forex Funds zero-spread accounts, where True Forex Funds offers trading spreads of 0.0 pips, which mimics institutional trading conditions.

Tips for practicing forex trading with a demo account

Recently, some authorities have questioned whether traders benefit from demo accounts since the price feeds may differ from real-time prices. The virtual environment may produce a false sense of security in trading actions. However, there remains a place to use demo accounts for forex trading. Traders must apply some tips to maximize the demo account experience. Here are some of those tips.

- The first step is to use the exact amount in your live trading as your demo account capital. There is no point using a $100,000 demo account if you will eventually trade with just $25,000.

- If you want to test your EAs and forex trading systems, your demo account is the best place to do it. Trade as though you would trade a live account.

- Practice your news trades on your demo account and see how the market responds to each specific high-impact news trade. Refer to the article on news trading for more information.

- Use your demo account to understand the contract specifications of your preferred asset. If you want to trade Gold and need to know what a lot size of 2.0 translates into in terms of profits or loss, it is better to use your demo account to understand this. Again, refer to the article on TFF’s contract specifications to better understand this point.

V. Conclusion

This article has delved into forex trading and stock trading, explaining their origins, how they work, and which is the more profitable between both investment vehicles. Both stocks and currency pairs are offered on the MT4 and MT5 platforms, the trading portals on which the True Forex Funds evaluations are run. However, the forex pairs provide a better option to trade as the news releases responsible for their movements follow a schedule.

If you are interested in resources for further education that will advance your forex trading and investing process in the right direction, consider reading the following materials suggested by this article’s editor, himself.

- Richard Dennis – The Turtle Trader (trend follower)

- Steve Cohen – Stock Market Wizard

- Mark Douglas – All About The Correct Trading Strategy Mindset

- Charles Faulkner – Trading strategy trader and programmer

- Richard Driehaus – Turtle Strategy Trader

- Van K. Tharp – The psychology of trading

- Brett Steenbarger – All About Trading Psychology